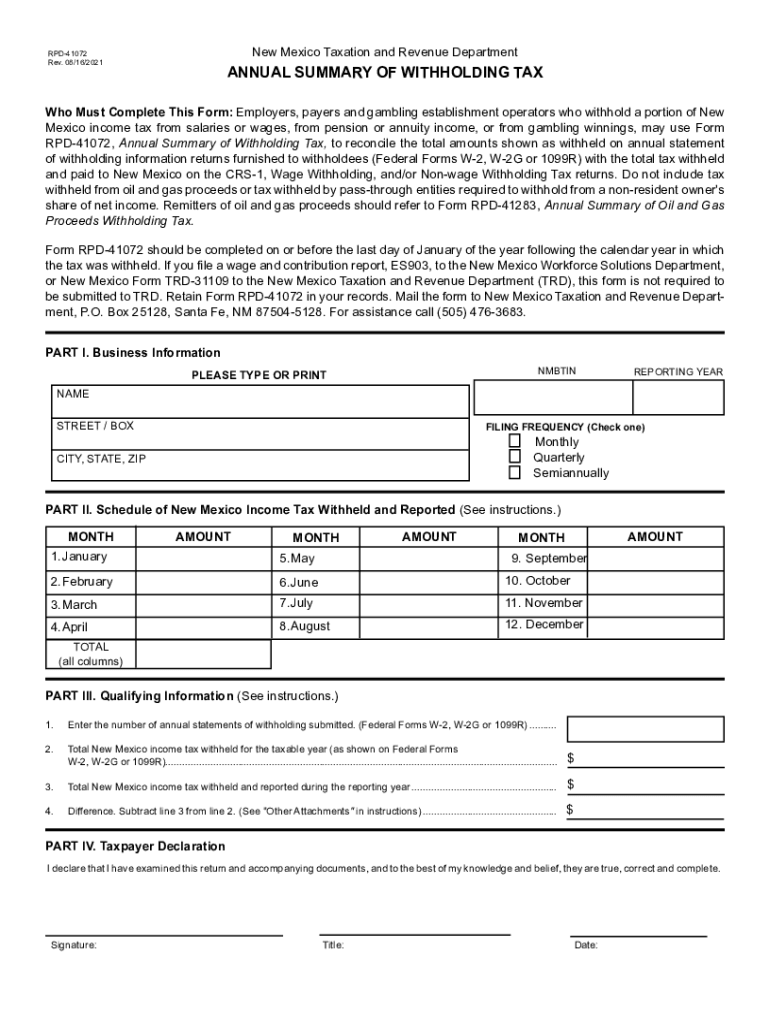

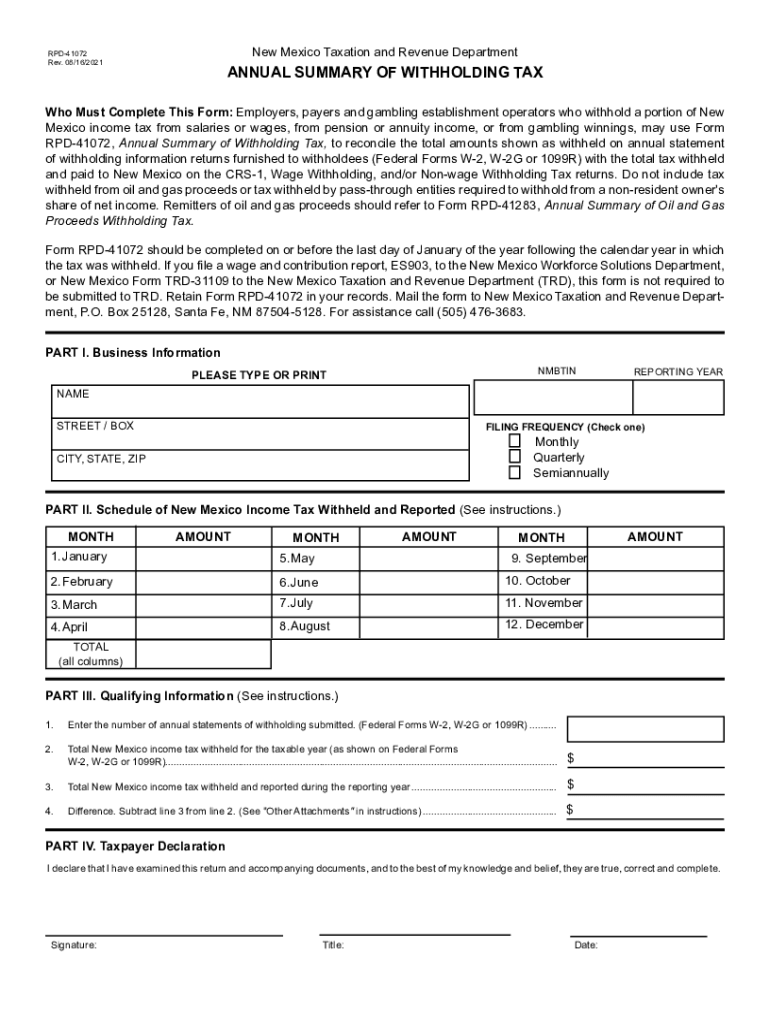

NM TRD RPD-41072 2021-2024 free printable template

Get, Create, Make and Sign

How to edit rpd 41072 online

NM TRD RPD-41072 Form Versions

How to fill out rpd 41072 2021-2024 form

How to fill out rpd 41072 new mexico:

Who needs rpd 41072 new mexico:

Video instructions and help with filling out and completing rpd 41072

Instructions and Help about mexico crs 1 form

In this tutorial you will learn how to file a combined reporting system or CRS return in tap to begin log in to your tap account logging into tap brings up your personalized home page select the account ID hyperlink for your CRS account notice the orange triangle in the account alerts and periods columns these indicate action is required for this period either a balance is owed Ora return needs to be filed to file return either select the desired period and file from there or select the file your return hyperlink for any given period in the account alerts list theirs return introduction page is displayed click Next to continue the registration page is displayed this contains taxpayer information on file if this is correct click Next to continue the CRS returns display to report gross receipts click the yes button then select add edit receipts no gross receipts are listed currently, so we will click add a receipt to add anew gross receipt enter gross receipts information into the pop-up window note that the fields in gray are non-editable calculated fields which are populated by performing calculations on the above entered fields when all gross receipts have been entered click OK use selector buttons to enter compensating withholding and business credit clean forms as applicable for this example we do not have compensating or withholding, but we do have business credit clean forms click no for compensating and withholding and clichés for business credit clean forms select the checkbox for the appropriate form then select the attachment claim form hyperlink to add your attachment enter a description of your file then select the file stored on your computer click save to finis hall attachments submitted are now displayed at the bottom of your screen to complete your form select the red signature checkbox to confirm information to be true and correct then click the submit button to submit and onto confirm this window displays a confirmation message along with a confirmation number for your request using the buttons at the bottom of the screen you can proceed by making payment printing a copy of your return printing the confirmation page or choosing ok to return to the account screen click the request and correspondence tab then click view alto view your return request select the request hyperlink to view request detail when you are finished select the log-off button to end your session this concludes the filing a CRS return in tap tutorial

Fill rpd 41072 mexico form : Try Risk Free

People Also Ask about rpd 41072

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your rpd 41072 2021-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.